Once you have access to your credit report, your main task begins. According to CNBC, one-third of Americans found errors on their credit reports. Some other estimates put this number at more than 50%. So what does this mean for you?

Unless you regularly check your reports, you will not know if there is any incorrect, outdated, erroneous, or unverifiable information listed on them that can adversely impact you.

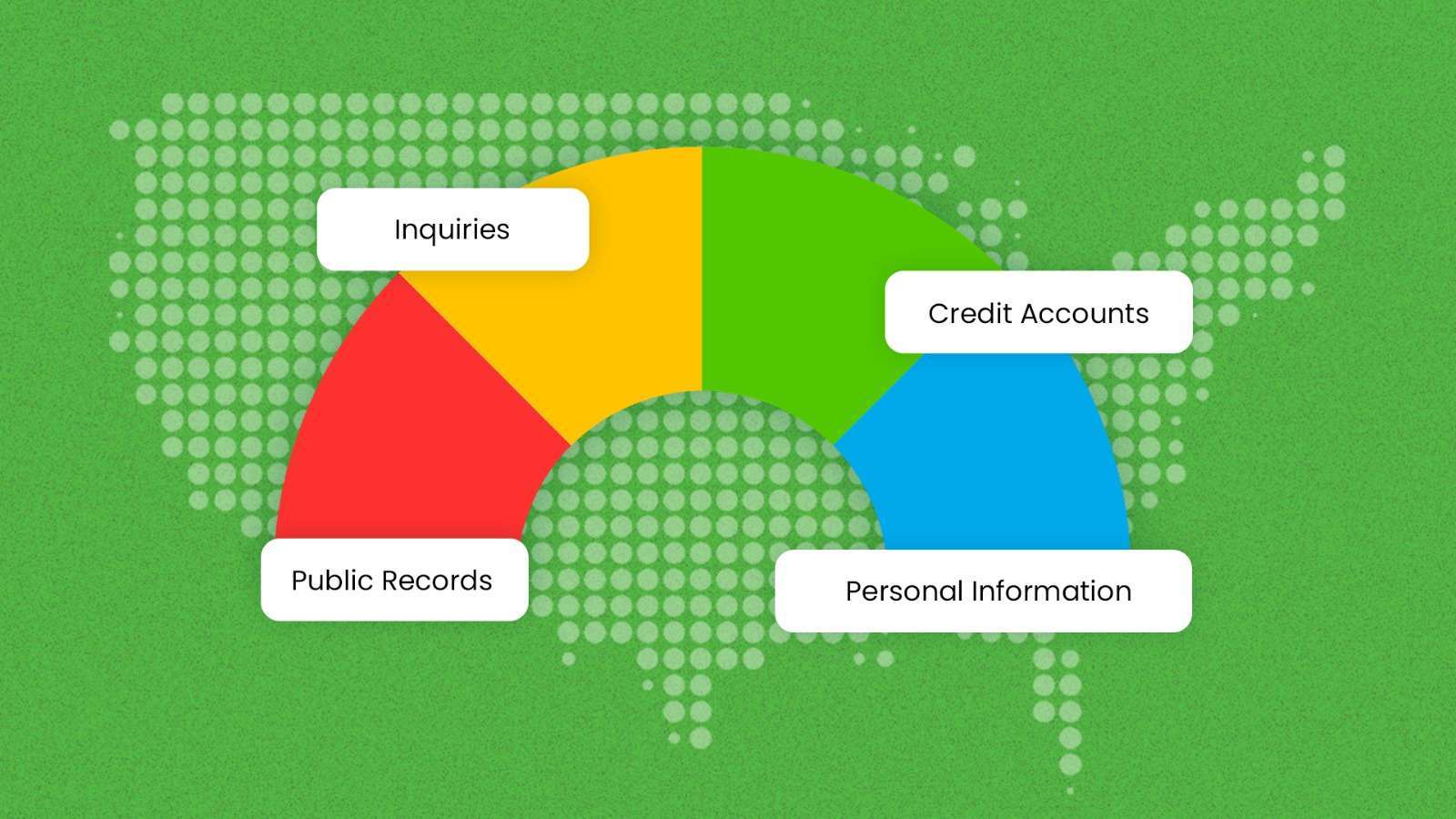

Simply put, you have to read and understand your credit reports regularly. We recommend 4 items that you should always look out for on your credit reports.

- Personal Information: First of all, your personal information including your name, Social Security Number, address, date of birth, and employment information should be up to date and accurate. This is one of the most important items that you should be looking out for on your credit reports.

- Credit Accounts: Always make sure you recognize all credit accounts listed on your credit report. These can be credit cards, personal lines of credit, mortgages, loans or any other account that you have opened with any financial institution. Also, check for payment history to make sure all payments are reported and no negative information is showing up for payments that you have already made.

- Public Records: Check for any entries in your credit report that might be showing on public records such as adverse judgments, liens and bankruptcies. Keep a look out for any information from collection agencies with state and county courts.

- Inquiries: Take a look at the inquiries listed on your credit reports. Review who has requested your report to verify that you indeed initiated that inquiry.

Your credit reports and their content can impact your creditworthiness. We recommend that you check your credit reports every month. You might be aware (or not) that mortgage lenders also look at your credit scores. A low credit score may make it harder to get approved and even if you do, it may cost you thousands of dollars in additional interest payments and fees.

Start your journey now. Having bad credit or no knowledge about credit reports is not the end of the world. You can start now to become more aware of your credit health and work to improve it. Monitor your credit score regularly so you get access to more financial products.

Keep reading our blogs and follow us on Facebook and Instagram for more…