Identity theft is a serious reality in the digital world. According to The Identity Theft Research Center’s (ITRC) Annual Data Breach Report, 2022 had the second-highest number of data compromises in U.S. history in a single year. As our lives become more digitized, this trend is likely to go up.

So, what is this all about? Identity Theft is a type of crime that involves the illegal use of someone else’s personal and financial information to commit fraud or other illicit activities. If you become a victim of identity theft, it can have serious consequences. It is likely that you have encountered someone in your network who has suffered due to Identity theft.

If someone steals your identity, they can wreak havoc on your financial stability, credit score, and overall lifestyle. In addition to financial loss, identity theft can also impact your mental health and well-being as it can be a time-consuming and stressful process to resolve the issue. In today’s busy life, the last thing you want to deal with is the additional stress in your life caused by someone else’s actions. This is why it is crucial to take preventive measures for protecting your personal and financial information.

- One of the most effective measures to prevent identity theft is by regularly monitoring your credit report and bank statements for any suspicious activity. One red flag that you should look out for is for bills showing up on your statements for items that you did not purchase. Another trigger can be debt collection calls from debt agencies for loan accounts that you did not open.

- You can also protect your personal information by strengthening your passwords (we recommend creating complex passwords), avoiding giving out sensitive information on public Wi-Fi networks, and being cautious of phishing scams. If you are not familiar with this term, Phishing is a common scam these days that involves tricking individuals into providing sensitive information through fake emails, phone calls or websites. If you suspect that you received phishing emails, you can report them to the Federal Trade Commission in USA. Simply forward it to the Anti-Phishing group at reportphishing@apwg.org. If it is a Phishing text, you can forward it to SPAM (7726). The US Government has also set up a dedicated online website for monitoring and reporting phishing attempts. You can visit FTC’s Report Fraud website to submit your claim.

Don’t be afraid of reporting suspicious transactions on your statements to Banks and Financial Institutions.

- It is also recommended to shred any personal documents and mail that contain sensitive information before throwing them away. Doing so can significantly reduce the risk of becoming a victim of identity theft and can safeguard your financial and personal well-being.

- Always inspect your credit card and debit card receipts. These receipts should not contain your full credit card or debit card number. Usually, it should only show 4 digits of your card. If the receipt shows your entire card number, you should immediately contact the merchant as well as filing a complaint with the relevant consumer protection agencies. For example, in the State of Texas, you can file a complaint with the Texas Attorney General’s office. Always do your due diligence before filing such complaints as they may become part of public record.

Even Children are not safe from Identity Theft

- Identity Theft targeting Children is also on the rise. A thief could easily steal a child’s social security number and use it to open credit accounts or take out loans. What that means i that the thief can build a fake identity using a child’s SSN and create a credit history file for many years. We recommend that you keep your child critical documents such as medical records, birth certificate, social security card, and Passport etc in a secure place. Contact the Credit Bureaus as soon as you find out about the theft so that they can freeze the child’s credit report and prevent any further damage. You can also file a complaint with the Federal Trade Commission. Most importantly, educate your children on the importance of information privacy and teach them about the importance of keeping their personal information safe and what to do if someone asks for it.

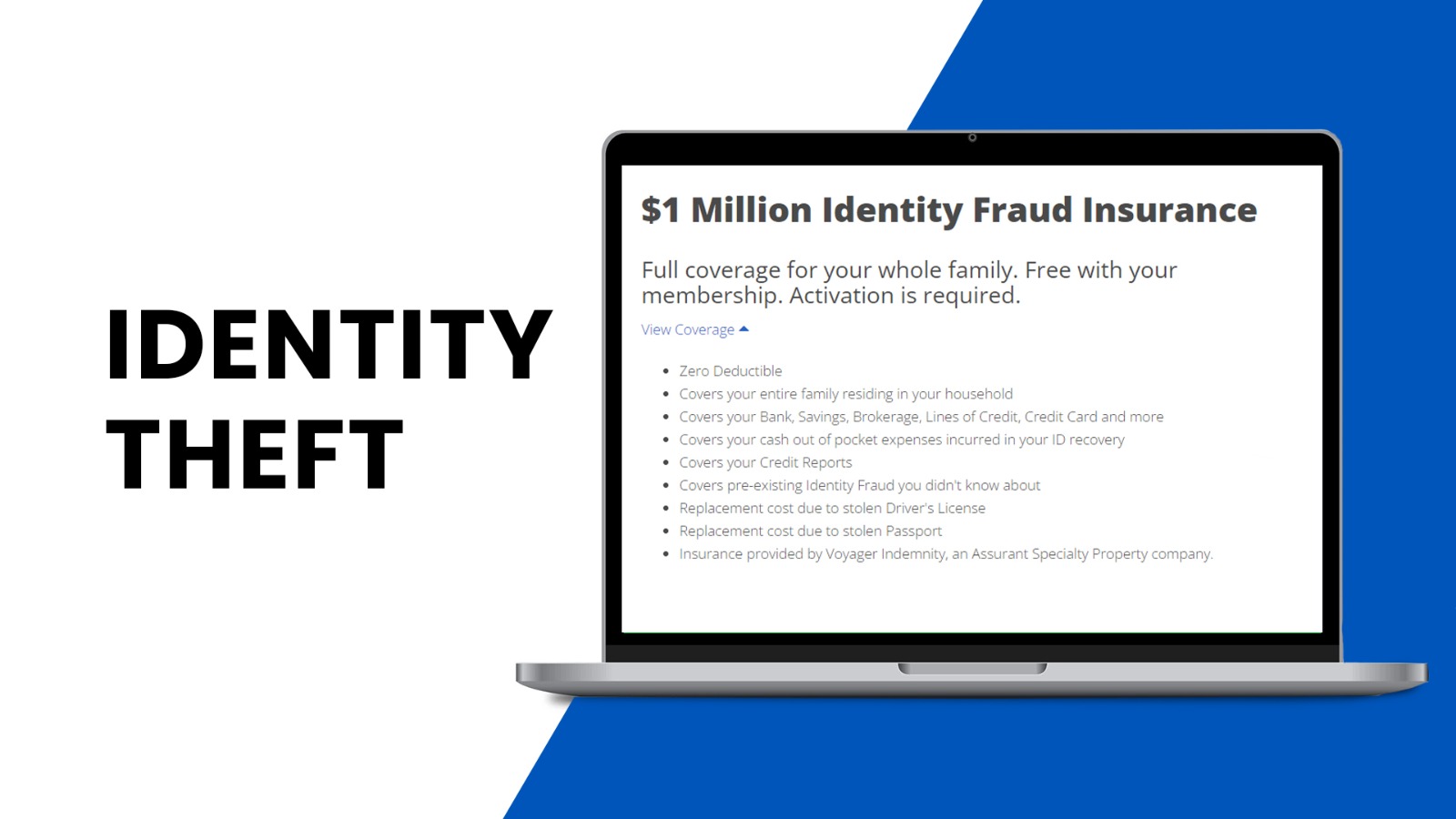

- So, what else can you do to protect yourself and your loved ones? Get ID Insurance. CredKin’s Platform also offers Identity Theft Protection insurance for upto $1 Million for you and your family. Not only that, CredKin’s subscription also offers additional features such as your email monitoring so we can help you identify sites and services on the internet who are selling or sharing your private information. Contact our team today and we can help you sign-up and get started.

Follow CredKin on Facebook and Instagram and learn more about credit management.